Απάντηση ΟΣΕ στον Τσίπρα: Η τηλεδιοίκηση Λάρισας άρχισε να υπολειτουργεί το 2015- Δεν επισκέφθηκε τις εγκαταστάσεις

ΚΤΕΛ Μακεδονίας: Αύξηση της επιβατικής κίνησης έως 100%-Θα υπάρξει «ανταγωνισμός» με τις λεωφορειακές γραμμές της Hellenic Train; GRTimes.gr

ΚΤΕΛ ΗΡΑΚΛΕΙΟΥ ΛΑΣΙΘΙΟΥ Α.Ε. - Ενημερώνουμε το επιβατικό κοινό ότι από Δευτέρα 7/3/2022 τα δρομολόγια εκτός Κρήτης διαμορφώνονται ως εξής : -------------------------------------------------------------------------- Από Ηράκλειο προς Λαμία-Λάρισα ...

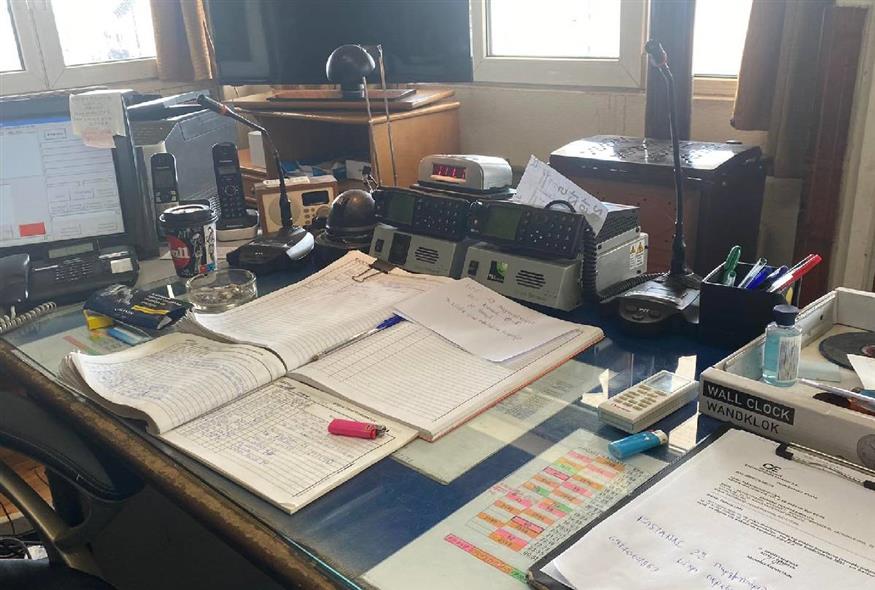

Τριτοκοσμικές συνθήκες στον μεγαλύτερο σιδηροδρομικό κόμβο της χώρας: Αναβοσβήνουν συνεχώς λαμπάκια - Με μπακαλοτέφτερα η κυκλοφορία | Έθνος

ΚΤΕΛ ΗΡΑΚΛΕΙΟΥ ΛΑΣΙΘΙΟΥ Α.Ε. - Ενημερώνουμε το επιβατικό κοινό ότι από Κυριακή 27/09/2020 τα δρομολόγια εκτός Κρήτης θα είναι : | Facebook