Υγρασία και μούχλα τέλος: Το "μυστικό" υλικό της κουζίνας που δεν φαντάζεστε ότι μπορεί να σας λύσει τα χέρια - Σπίτι - Athens magazine

Πλυμμένα ρούχα: Τα μυστικά για να τα στεγνώσετε γρήγορα ακόμα και όταν έχει υγρασία - Σπίτι - Athens magazine

Υγρασία στο μπαλκόνι: Κάντε την παρελθόν με ξύδι και 1 ακόμα υλικό που θα σας απαλλάξει οριστικά - Σπίτι - Athens magazine

Ανδρικό σώβρακο που απομακρύνει την υγρασία Ψηλόμεσο μονόχρωμο βαμβακερό ύφασμα αναπνεύσιμο άνετο μπόξερ σλιπ με ζώνη με αντίθεση – τα καλύτερα προϊόντα στο ηλεκτρονικό κατάστημα Joom Geek

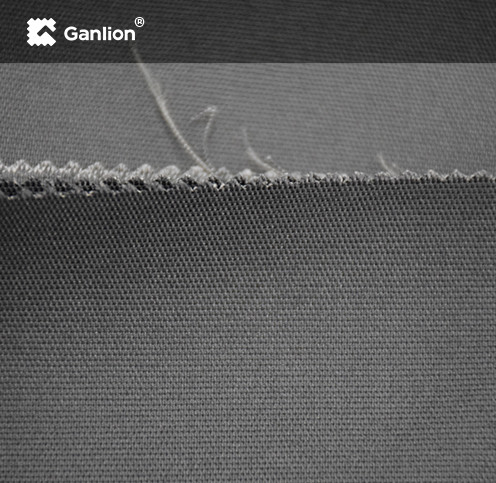

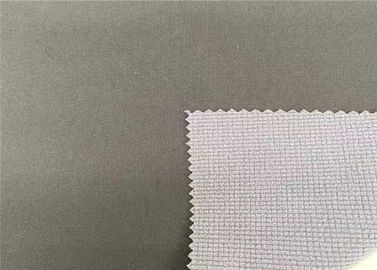

Κίνα Πολυεστέρας υγρασία Wicking Ύφασμα κατασκευαστές και προμηθευτές - Εργοστάσιο Χονδρικό - K & M Textile

Τι κι αν βρέχει; Τι κι αν έχει υγρασία; Έτσι θα στεγνώσετε γρήγορα τα ρούχα σας μέσα στον χειμώνα - Σπίτι - Athens magazine