Father-Daughter Beatboxers Ed Cage & Nicole Paris: Their Most Viral Moments | JenniferHudsonShow.com

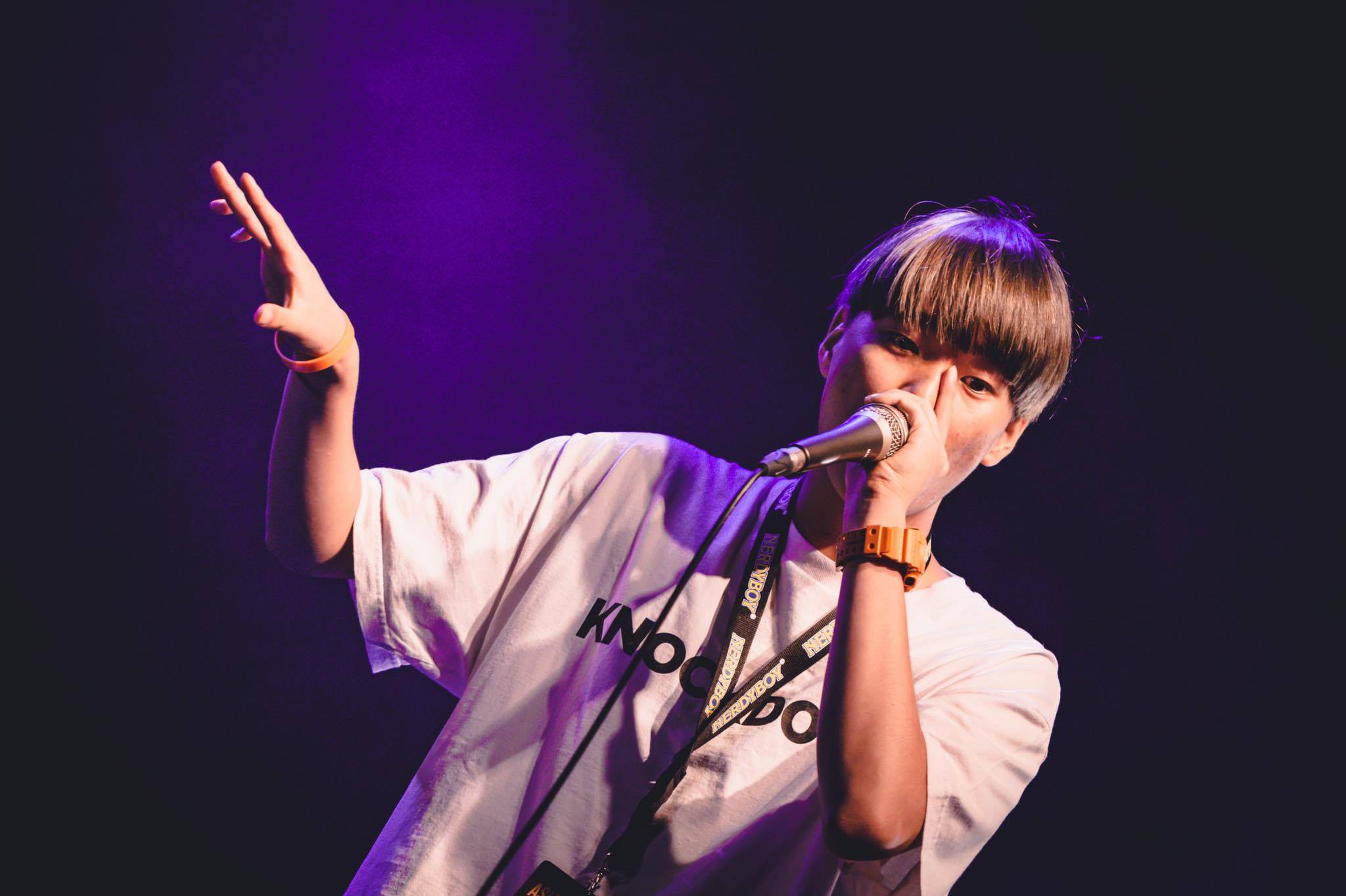

swissbeatbox on X: "❤️❤️❤️TOMMOROW WE WILL HAVE THE ONE AND ONLY BIGMAN FROM SOUTH KOREA 🇰🇷 EXPECT SOME BEAUTIFUL BEATBOX LOVESONGS 🔥😍🔥#beatbox #grandbeatboxbattle #beatboxing #ellen #bigman #bigmanbeatbox #showcase #stage #mic @bigman.bbx ...

These beatboxing skills are unforgettable. Just watch. | These beatboxing skills are unforgettable. Just watch. | By Ellen DeGeneres | So this is your first time in the United States. Yeah. Yeah.

The international beatboxing crew Berywam is about to blow your mind! | The international beatboxing crew Berywam is about to blow your mind! | By Ellen DeGeneres | Our next guests are