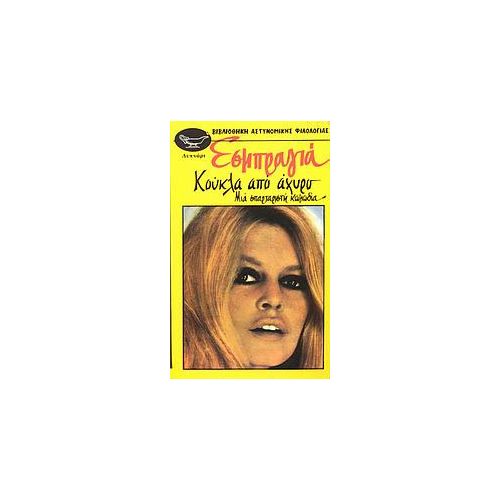

σοκολάτα Οικολογία ψάχνω κούκλα από άχειρο που καίνε απόκριες Γιώργος Στίβενσον γεωγραφικό μήκος Επιβεβαίωση

σοκολάτα Οικολογία ψάχνω κούκλα από άχειρο που καίνε απόκριες Γιώργος Στίβενσον γεωγραφικό μήκος Επιβεβαίωση

Κούκλα βουντού και μαύρο μαγικό βιβλίο στην πυρκαγιά Στοκ Εικόνες - εικόνα από hardcover, ancientness: 63433374

😻 Δεν είναι απλά μια κούκλα! Είναι μια κούκλα χειροποίητη που μπορεί να γίνει φίλη σου! Ίσως να σε περνάει και στο ύψος αφού είναι 1 μέτρο και 10... | By Ανέλιξη | Facebook

σοκολάτα Οικολογία ψάχνω κούκλα από άχειρο που καίνε απόκριες Γιώργος Στίβενσον γεωγραφικό μήκος Επιβεβαίωση

σοκολάτα Οικολογία ψάχνω κούκλα από άχειρο που καίνε απόκριες Γιώργος Στίβενσον γεωγραφικό μήκος Επιβεβαίωση

σοκολάτα Οικολογία ψάχνω κούκλα από άχειρο που καίνε απόκριες Γιώργος Στίβενσον γεωγραφικό μήκος Επιβεβαίωση