Maui & Sons Tribal Σχολική Τσάντα Τρόλευ Δημοτικού Πολύχρωμη Μ33 x Π28 x Υ48cm 339-99074 | Skroutz.gr

Gim Fur Fashion Σχολική Τσάντα Τρόλευ Δημοτικού σε Ροζ χρώμα Μ35 x Π15 x Υ46cm 349-65074 | Skroutz.gr

Miquelrius Oh My Cat Σχολική Τσάντα Τρόλευ Δημοτικού σε Ροζ χρώμα Μ27.3 x Π24.3 x Υ54cm 19632 | Skroutz.gr

Polo 9-01-016-8121 Rolling Σχολική Τσάντα Τρόλεϊ Δημοτικού Πολύχρωμη Μ33 x Π24 x Υ42εκ 9-01-016-8121 | Skroutz.gr

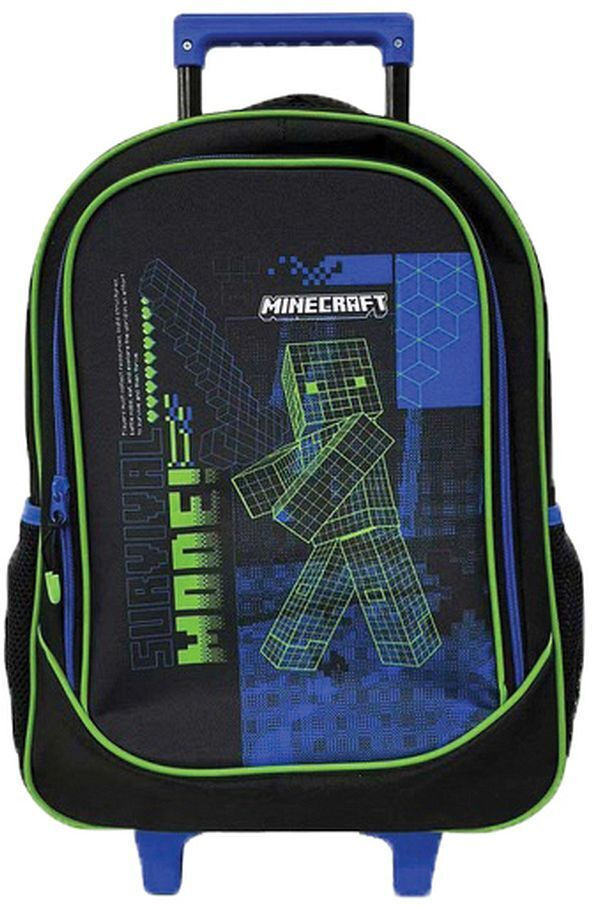

Graffiti Minecraft Σχολική Τσάντα Τρόλευ Δημοτικού σε Μαύρο χρώμα Μ30 x Π14 x Υ44cm 218251 | Skroutz.gr

Must Captain America Σχολική Τσάντα Τρόλεϊ Δημοτικού σε Μπλε χρώμα Μ34 x Π20 x Υ44εκ 000506096 | Skroutz.gr

Back Me Up Dinosaur Σχολική Τσάντα Τρόλεϊ Δημοτικού σε Μαύρο χρώμα Μ33 x Π28 x Υ48cm 357-05074 | Skroutz.gr

Lyc Sac One Rock 'n' Roll Σχολική Τσάντα Τρόλεϊ Δημοτικού Pink Vibes + Κασετίνα Δώρο Μ35 x Π24 x Υ44εκ 11547 | Skroutz.gr

Santoro Sugar Plum Σχολική Τσάντα Τρόλεϊ Δημοτικού σε Μωβ χρώμα Μ30 x Π14 x Υ44cm 217253 | Skroutz.gr

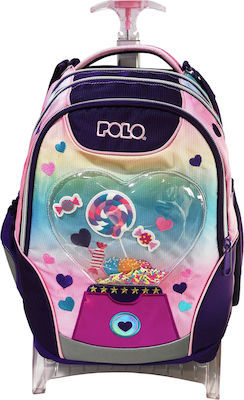

Polo Heart Σχολική Τσάντα Τρόλεϊ Δημοτικού σε Μωβ χρώμα Μ30 x Π17 x Υ40εκ 9-01-007-8118 | Skroutz.gr

Back Me Up Video Game No Fear Σχολική Τσάντα Τρόλεϊ Δημοτικού Πολύχρωμη Μ33 x Π28 x Υ48cm 347-86074 | Skroutz.gr

Back Me Up Pink Deer Σχολική Τσάντα Τρόλεϊ Δημοτικού σε Ροζ χρώμα Μ33 x Π28 x Υ48εκ 357-11074 | Skroutz.gr